Follow these 5 practical steps to Buy a House while keeping your stress levels low. Make the home-buying process easier, smoother, and more enjoyable.

Follow these 5 practical steps to Buy a House while keeping your stress levels low. Make the home-buying process easier, smoother, and more enjoyable.

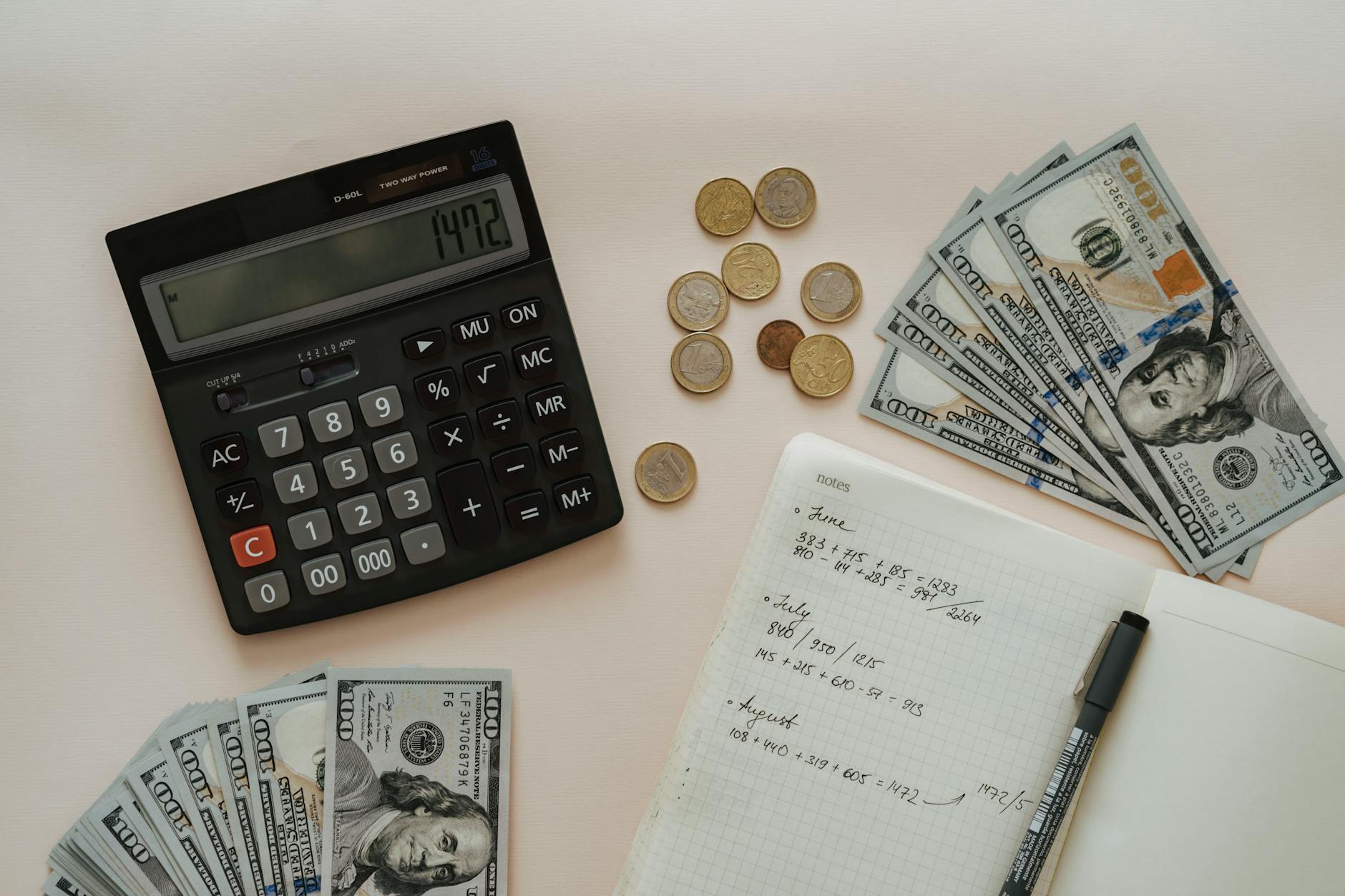

Money touches every part of life; you may aim to build savings, reduce debt, or plan for years later. You want realistic strategies that fit your daily routine. This post offers clear actions to set stronger foundations for financial well-being. You’ll learn how to shape small financial habits that support savings, investments, and preparing for life’s transitions.

Smarter spending isn’t about cutting everything back; it’s about spending with intention. Whether you’re managing a household, saving for the future, or trying to stretch your income, small decisions can lead to big results. Getting more for your money means thinking beyond the initial cost and focusing on long-term value, practicality, and peace of mind.

Although the real estate market has endured a little more volatility in recent years than it has in previous generations, property investments remain one of the most effective instruments for building personal wealth.

Discover tech-savvy savings with budget-friendly smart accessories that deliver top-notch quality without the hefty price tag. Stay stylish, innovative, and affordable!

Managing money is both an art and a skill—yet it’s something we’re rarely taught in school. This lack of financial education can lead to challenges, but the good news is that it’s never too late to take control. Saving for a Healthy Financial Future starts with small, intentional steps that set you and your family …

Have bills piling up and can’t make huge payments at once? Learn about how paying in instalments may be your best option!

There is nothing quite as exciting as putting your key in the lock for the first time but covid-19 could affect house prices so should you wait to buy?

Comparing the pros and cons of taking out a mortgage to be a landlord is important, and this can help you determine whether you should own a house on behalf of someone else. Let’s discuss the pros and cons of being a landlord below.

No one wants to be in a situation where they are constantly worried about managing money. When you manage your finances well, it will help lift some of the burdens. Let’s consider how best to manage your money.

Error: No feed found.

Please go to the Instagram Feed settings page to create a feed.